How Sweden’s stock market became the envy of Europe

Simply sign up to the Capital markets myFT Digest -- delivered directly to your inbox.

In April last year, a group of nearly 60 EU officials travelled to Sweden on a fact-finding mission to meet Nasdaq Stockholm, operator of the country’s highly successful stock market.

During a two-hour session on “capital markets ecosystems”, the exchange’s executives explained why so many small and medium-sized businesses are deciding to list in Stockholm.

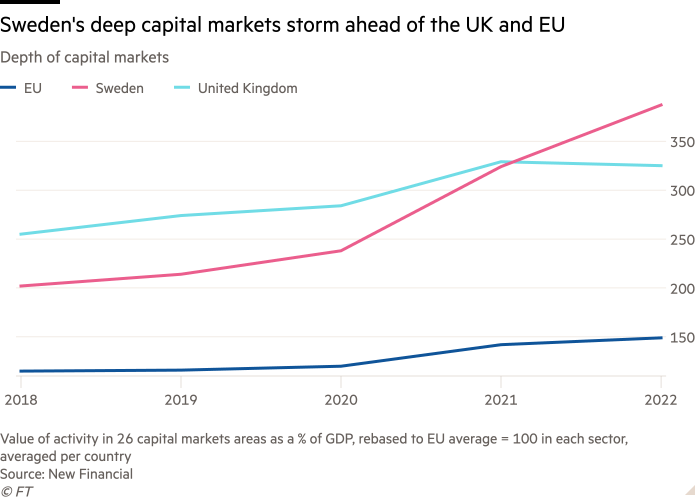

At a time when the UK and many other European countries are struggling to attract initial public offerings and suffering from falling trading volumes, Sweden stands out for having, relative to its size, thriving capital markets that are backed by legions of investors and which are even tempting foreign companies to list.

“Sweden now has the deepest capital markets in Europe,” said William Wright, co-founder of markets think-tank New Financial. “What they’ve realised is you do need this ecosystem and you need to encourage it at every step of the way.”

Policymakers across Europe are urgently trying to revive their own stock markets by changing listing rules and incentives for company founders, and by trying to encourage pension fund and retail investment in domestic stocks.

Yet Sweden already has a sizeable head start on other countries, having introduced many of these measures years, or even decades, ago.

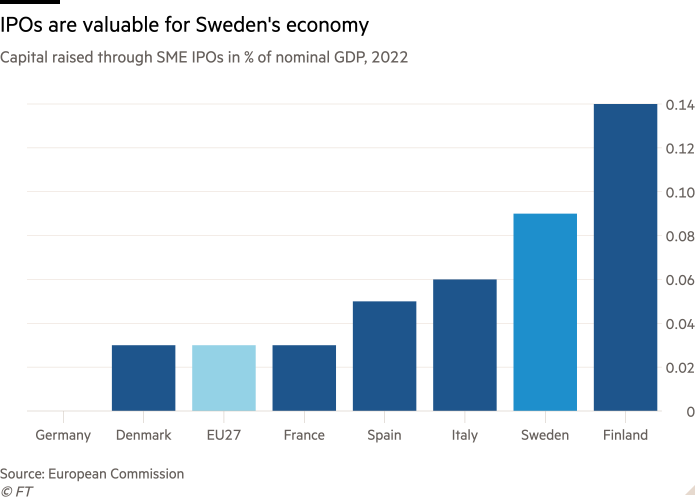

Over the past 10 years, 501 companies have listed in Sweden, more than the total number of IPOs in France, Germany, the Netherlands and Spain combined, according to Dealogic data. The UK is top with 765 listings.

While Sweden’s total IPO fundraising volumes are well below those in the US — where some larger Swedish companies such as music service Spotify and drinks maker Oatly have listed — the Nordic country has been highly successful at encouraging smaller domestic businesses to stay at home, encouraged by the depth of its stock market.

“Compared to the size of the country and also the size of the stock exchange, the [Swedish] IPO market has definitely been more vibrant in allowing smaller companies to list than others,” said Tony Elofsson, chief executive of Carnegie Group, a Nordic bank and asset manager. Around 90 per cent of listings are valued at less than $1bn, according to Adam Kostyál, president of Nasdaq Stockholm.

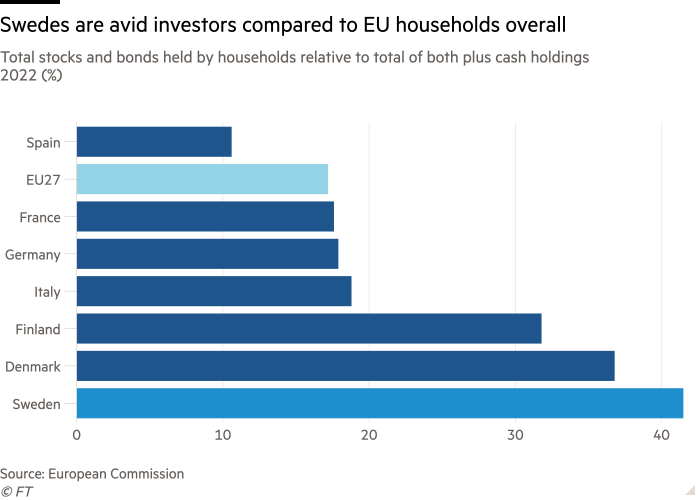

A key driver has been the country’s investment culture, which Carnegie’s Elofsson says has attracted “everyone from the man on the street to very engaged private banking investors, entrepreneurs, but also the small and mid-cap investment community”, referring to institutional investors.

Among larger investors, Swedish pension funds have long owned domestic equities. The country’s four biggest retirement schemes have roughly maintained or increased their holdings of domestic equities in recent years. In the UK, in contrast, domestic equity holdings among pension funds have plunged to about 4 per cent. Meanwhile, Swedish insurance companies have the highest holdings of stocks in the EU.

Large investors typically take the role of so-called cornerstone investors in IPOs, according to John Thiman, partner at law firm White and Case in Stockholm, giving confidence to businesses preparing to go public, and to other investors.

“Every single successful IPO has involved some level of cornerstone investors,” he said. “There is a very strong equity sentiment from rock solid investors.”

Retail investors are also big buyers of Swedish stocks, helped by a wealth of reforms in recent decades. Compared with the rest of Europe, Swedish households hold among the highest proportion of their investments in listed companies and among the lowest in bank deposit holdings, while financial literacy is greater than in Germany, France or Spain.

In 1984, the government introduced Allemansspar, a product enabling ordinary Swedes to invest in stock markets. By 1990 there were already 1.7mn of these accounts, helping drive the launch of domestically focused small and mid-cap funds.

Such funds arrived “10-to-20 years before any other country did anything similar, at least in Europe”, said Carl Rosenius, head of equity capital markets at Swedish bank SEB. “That’s been the success story in Sweden for sure, having large funds actively looking at domestic small and mid-cap opportunities.”

Rule changes in the 1990s allowed people to invest 2.5 per cent of the amount they allocate to their pensions into funds of their choice, supported by a public information campaign.

And in 2012 the state introduced investment savings accounts called ISKs that allow individuals to invest without needing to report their holdings or worry about capital gains or dividend tax. Instead, the total value of the account is taxed — and in 2024 that was at a level of about 1 per cent.

Some charities go into schools to educate those aged 16 to 18 about finance, for instance on the difference between shares and mutual funds, according to Joacim Olsson, chief executive of Swedish shareholder group Aktiespararna.

Other European countries are racing to encourage their populations to invest in stocks. The UK last month launched a £5,000 tax-free allowance for investing in British companies, while France’s finance minister, frustrated with the pace of EU reforms, has called for a few countries to forge ahead alone and create a new investment product.

Nasdaq Stockholm has even been trying to lure foreign businesses, for instance small and medium-sized companies in Germany, which Kostyál said is “underserved in terms of the local IPO market”.

“It’s clear that Germany has an infrastructure problem insofar that it’s very difficult for smaller companies to list there,” said Joakim Falkner, partner at Baker McKenzie in Stockholm. German investors have historically favoured bonds over stocks, making equity raising more challenging.

Myles Murray, founder of Irish medical equipment maker PMD Solutions, chose to IPO in Stockholm earlier this year, saying the plethora of comparable healthcare companies listed there meant analysts could more easily assess his company, compared with listing on Euronext Dublin.

Access to large investors was a big help. “We were a foreign company, pre profit, and the smallest of brokers could get a meeting with [the big pension funds] and that was very surprising,” said Murray.

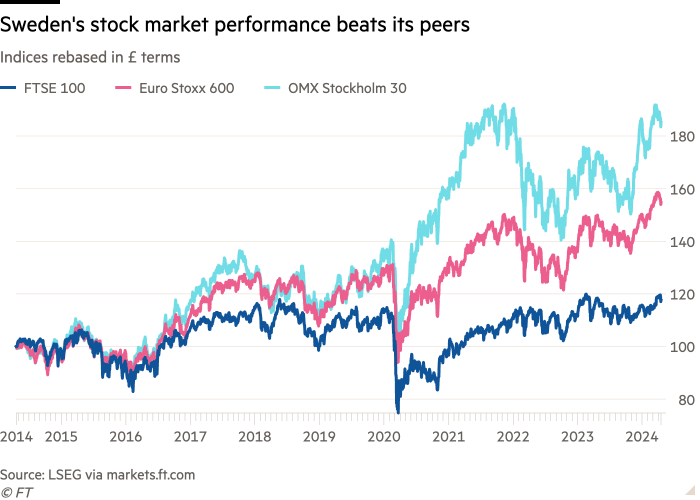

Sweden’s system appears to have translated into stock market returns. Its main index has gained 85 per cent over the past decade, while the Euro Stoxx 600 index has risen 49 per cent and London’s FTSE 100 just 17 per cent.

That, too, is helping persuade Swedish small and mid-sized companies to stay at home.

“Why cross the river to get water, as we say in Sweden,” said Carnegie’s Elofsson.

Letter in response to this article:

Stockholm market’s funding escalator / From Roger T Storm, Chief Executive Officer, Euroclear Sweden, Stockholm, Sweden

Comments